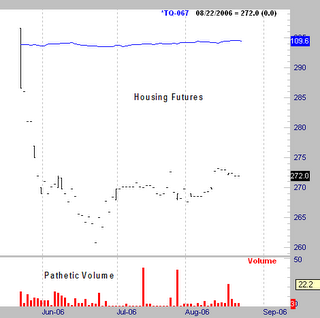

Housing Futures

Housing FuturesHere we have an update chart on the LA region housing futures. I hesitate to even call this a chart, it is just a bunch of dots on a page. The reason it looks like this is the complete lack of volume.

There are not even enough trades during the day to create daily ranges. This is a shame, as it undermines the usefulness of this product. As I have stated before, until the housing insiders become players in this market, it will not even be viable as a hedge play for individuals.

You could take a position, and be correct, yet not be able to get out of the trade with a profit due to the lack of liquidity. Now is a great time to be short housing just based on what appears to be a large scale dropoff that is beginning to unfold. However, you can not play it here with any degree of certainty due to low volume. I think the large scale players(builders) are hesitant to take a public short position for everyone to see for fear of undermining consumer confidence in this sector. That is just an opinion which may or may not be accurate. I do not know of another way for these companies to hedge their land cost positions which is currently cutting into their margins.

No comments:

Post a Comment