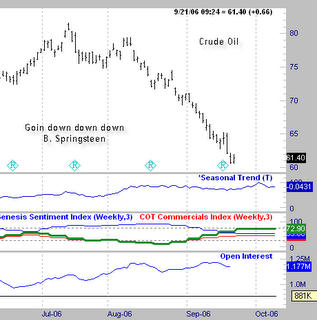

CRUDE OIL

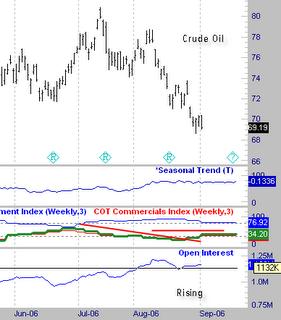

CRUDE OILHere is a weekly chart of Crude Oil. It is clear that we are in a strong down ward trend. The commercials got long during the decline, which is more than likely just normal hedging operations, but has resulted in a small rally against the trend.

If there were to be a move up toward the 67 area and an accompanying shift to the short side with the commercials, this would be a very nice short sale setup. It may not move up that far, but choosing ones spots carefully is a very important component of a successful trading strategy.

Sometimes moves are missed by waiting for things to line up properly. There are fellow traders of mine that have the mental makeup to trade at a very low win to loss ratio, knowing the big wins will overcome all the small losses. These folks just fire away at marginal opportunities all day long, not being able to afford to miss any move that comes along. This is a very dangerous game to play. I prefer to pick and choose my spots, and am willing to see moves go by if they are not setup properly.