FINAL INSTALLMENT OF THE FORECAST AND HOUSEKEEPING

Just to get this out of the way, the final standings in the World Cup show that my 6 month venture brought me a bronze medal. I discussed this recently, so I won't go too much into it beyond just showing the final standings. A return of 52% for 6 months is not bad I guess. This is the only contest that has people trading real money, that is why it is the only one that matters. Trading in a CNBC simulated trading contest is nowhere near the same thing as trading real dollars. I wish I had been in the whole year, since all of my competition was, and doing this in half the time is what makes me the most satisfied with it. Of course, my other botched business venture is what caused me to enter so late, so that is on me. Readers know that the entry in the contest from my venture was up 25% or so in the first quarter, before I pulled the plug on it for extraneous reasons not related to trading at all. Onward.

As to the rest of my forecast, I want to mention something about a market I have already covered, GOLD. If you are of the mindset that the bull market there will rage again, and no matter what happens you cannot be persuaded to change your mind, it is clear what you need to do. Do not ever look at charts of the price, EVER. One thing you don't want to do in trading and investing, is mix time frames and approaches. If you are bullish on Gold some of these reasons that people are putting forward about this new economic malaise etc.., there is no reason to look at charts or read comments from someone like me. You need to stick to your guns and just buy all the dips. Charts will potentially mince your thoughts. There is no reason to look at a price chart if you are not buying it because of a price chart. This is the same logic I use in reverse fashion about not considering these types of arguments when I trade off charts. I stick to my core approach which is charts not opinions. I hope this makes sense. Tune guys like me out, our approach is irrelevant to what you are doing. Who cares what we think or what we are doing.

I wanted to cover this because I happened to read an article about Gold on my Blackberry while I was waiting at the vets office the other day. It was written by a bullish writer, and it was so confusing. It was basically talking about a great buy coming but it was not here. He went on to say it could be anywhere from days to months! Good grief! That sure is a lot of help isn't it? Stick to your guns and don't mix approaches. Speaking of that I did mention I thought the take out of that low would result in a trap and short term reversal, and I was right about that.

CRUDE OIL

I do not have great vision for this market coming into 2012. We currently are in a solid up trend, and we recently had Open Interest get down to a low level not seen in years which is very bullish. However, we have seen the link between this market and stock prices. It is hard to imagine a big bull market in Crude without one in stocks. Due to my view on stocks, I think this market is going to rally some at the beginning of the year, but that rally is going to be tempered by stock prices being flat to weaker. On a relative basis this market has switched to being stronger than stocks, so it should remain so.

The one wild card that is always out there is T Boone Pickens. If he happens to come out and publicly announce Crude is going way higher, we will need to shift to shorting with both hands almost immediately. It is perplexing how someone who has made billions of dollars in Oil is such a poor prognosticator of price direction, but it is what it is. The last two times he has come out and made big appreciation calls, this market has fallen off a cliff within a week or two. Barring the TBP effect, I am looking for higher prices during the first part of the year, but not a runaway bull move. I do think we will have a pretty sharp down move that will happen at some point, and my best guess is either May/June or in the late fall. These are just guesses based on cycles and really not worth anything to be honest.

I do not have at the moment a clear short term signal, although as of today it looks like more of a buy than a sell.

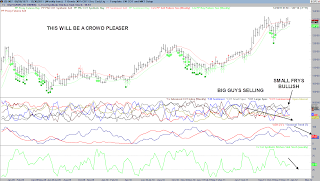

The next chart is the CRB Index. We are at a point where the water cooler economists are going to have to be proven right pretty soon, or even they are going to have to give it up.

The theories are that all the "money printing" that is going on is going to cause a huge amount of inflation. You would think if we had a lot of inflation, that commodities would be rising. Do you see them rising on this chart? What they miss is the concept of velocity. The money supply does not mean anything, if it is not turning over at an increasing rate. We are at a point in time where the seasonal tendency is for prices to rally, and we have followed the overall seasonal bias very closely here. If we are going to have this huge explosion upward, this is the spot where it is going to come from. I am and have always been in the deflation camp. However, if we were to switch to an up trend here at this time of the year, I might change my mind. For now the trend is still solidly down.

This is pretty much it. I don't have time to summarize every individual market and if I did that would be a pay per view service. The recent posts have covered in a broad brush fashion, what I am looking for. I am a short term trader, so at times I will trade in opposition to longer term trends. I do not consider them in my short term trading unless they happen to sync right up with an entry, then I look for the move to be larger.

Happy New Year and thanks for reading in 2011