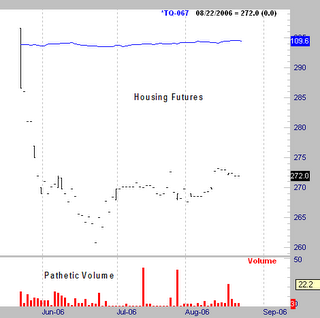

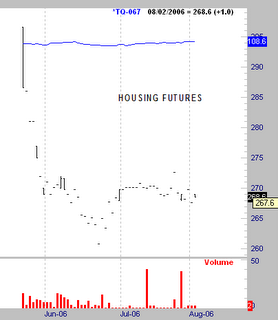

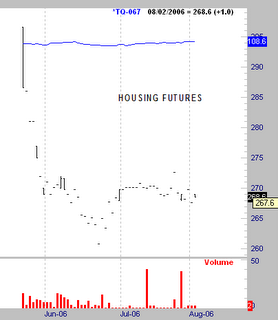

Housing Futures

Perhaps the only thing that is a bigger bust this year than housing itlself, is the housing futures launch. This is a textbook example of what we would call an illiquid market.

If you just take a cursory glance at all of the other charts I post in here, you will immediately notice a big difference. This chart is just a bunch of dots. Also, looking at the volume at the bottom, there is not much if any trading going on at all in this market.

I had stated openly, that I feared this would not be the vehicle everyone hoped for prior to it being launched. There were a couple of reasons why I felt this way. First, to fully hedge the amount of equity many homeowners have, someone would have to take a very large position. Since everyone would be looking to take the same side of the trade, liquidity on any exits would be unlikely. As a result, you could be right about a drop in price, but by the time you got out, you could actually lose money.

Someone has to be on the other side of the trade for this liquidity to be there. The second reason was that I thought the homebuilders would be hesitant for PR reasons to hedge in this market. They are the ones who could place enough money in this market to create liquidity. However, can you imagine what would happen if a story came out that said a large builder had just recently taken a big short position in housing futures?

Time will tell if this market has a future. Maybe as the price drop picks up some steam, volume will pick up. However, I would suggest that it will not. The big players (builders) already know what is in the process of happening, and they are still not putting any money here. It would be contra to the nature of insiders to chase something down. The hedging they generally do is on the front side.

Participation by the "big money" is always needed to provide proper liquidity for trading. Until this market picks up some of that, it is not worth looking at.

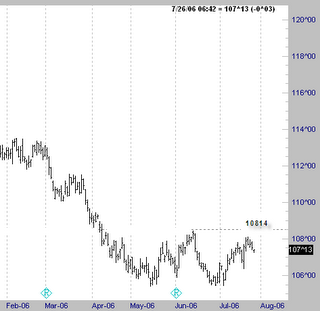

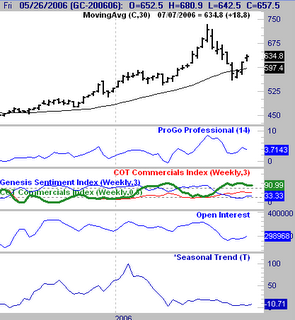

Heavy Lumber

Heavy Lumber