What to do when you miss a big opportunity?

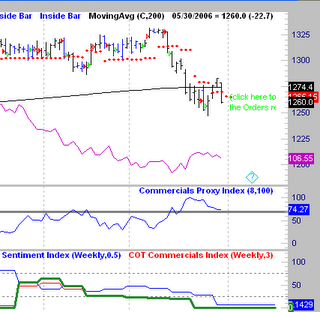

What to do when you miss a big opportunity?This past weekend I had a very strong feeling a good size selloff would happen today. As it turns out, I was right. I had a few possible sell orders for the S&P, but unfortunately, none of them seemed likely to trigger.

I spent hours researching the pattern, to see if my strong feeling had any basis in fact. Were there any other possible short sale entries in play? Even though I did find an "edge" toward the downside, I was not able to find any additional sell patterns, that meet my parameters for a trade.

When this happens, what do you do? The answer is, nothing. As can be clearly seen, the market did in fact have a very strong down day. This would have been a huge profit, but it was not to be. At times this will happen. A very big part of being disciplined in trading, is knowing when to trade and when not to.

Sometimes this will mean being on the sidelines on big days like this. As a trader, you simply have to move on to the next opportunity. I have warned here of additional downside action, so expect to see more of this type of action over the next several months. There is nothing on the horizon that I can see, indicating the downtrend is at an end.

2 comments:

I read in the paper today that yesterday, the dollar took its biggest tumble against the euro in one month.

Comments made by someone who has never made a trade. Look at the chart I sent you. Does that really look like a dramatic move?

This is why I do not read that stuff.

Post a Comment