IT IS NOT IN THE DATA

I heard what was probably the best response I have heard yet from a prominent Fund Manager when asked the question about whether people should put their money into Gold right now. The dialogue was along the lines of the inflation we are getting into now that the Government is telling is does not exist. His answer was that if you are seeking out Gold as a hedge against inflation, not to do so for that reason. He cited the 20 year period from 1982 to 2002 where we had steady 4% inflation and yet Gold dropped by almost 70% during that time. His summary was that the relationship is not in the data. There might be other reasons as to why someone might want to buy Gold, but his answer was not to do it for that reason. He said TIPS were far and away the best place to go for safety from inflation. These are consistent with the points I have been making about his now for 2 years. Make no mistake about it, the current uptrend is probably the greatest up trend of all time in any market, but inflation has not been driving it.

The one danger that I see with TIPS is that the government is playing with the numbers, so something indexed on government reporting that is fraudulent is not likely to be too safe either. If we get the June top in stocks that is being forecast by some, the commodities markets will crash, so that will save that argument for another time. We may or may not get that top, it is yet to be determined. I had said last week that I was looking for a dollar decline, currency rally and stock rally. We have gotten all of those, so for the moment there is no top in sight.

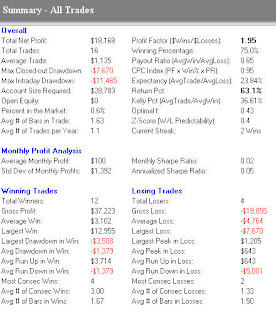

The QQQ trade I had legged into last week was exited on the close Friday for a decent gain.

I bought 2 units on the close 2 days in a row into weakness and exited on strength. The way the night session is going tonight I wish I had held them, but the rules dictated and exit so I did so, onward.

The END OF QE2

Does anyone really believe this is truly going to end?

They have engineered the greatest stock rally of all time with this program and it's predecessor. Millions of people have gotten completely whole and then some in their retirement accounts. Our "recovery" seems to be slipping some based on some recent economic numbers if you can believe any of them. Why in the world would they risk letting this all come undone?

I do not think they will.

The PPT has been operating behind the scenes for years so there is no reason why they cannot ramp that type of stuff back up, when the "transparent" manipulation is discontinued. We will need to watch for the suspicious buy programs that come out of the blue especially when the market is on the verge of tipping over. If we start seeing that again, we will know they are still at it. It is entirely possible as some have suggested, that Uncle Ben will step away from the mouse and let this thing start to roll over. By doing so the cries for QE3 will come out and he will be able to say I told you so.

Here is the danger in doing that. If they allow the natural forces to start to move this sucker down, they are going to be confronted with volume that will be too big for them to handle. There are alot of big fund people that have their hand on the trigger for exits the minute this thing gets a little weak, and once those orders get triggered, the PPT will not be able to stop things. They simply have to stay in front of this market and I think they are going to try. This month is definitely must see TV, and I am ready if the million dollar short presents itself. I do not know if it will or will not at this point.

I have decided to do a little day trading again, so I will give updates on how that is going. I just decided I have too much money just sitting idle at times and it is the american way to max out your opportunities, so I intend on doing so.