Correction?

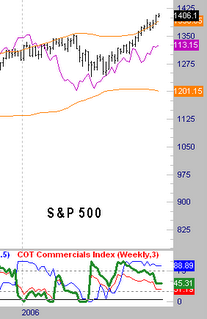

We finally got what appears to be the first leg of a correction. Is this the beginning of something more or not?

So far it is tough to tell. There has been some heavy insider selling going on toward the end of this up move, which could spell some trouble. However, in the absence of that, this appears to just be the beginning of a long overdue correction. Notice how strong the bond market is underneath, which is what we want to buy into a decline.

We have broken the most aggressive uptrend line so far, and are sitting on the second most aggressive trend line. This is to be expected. Upmoves that just go on and on without meaningful retracements leave themselves vulnerable to these quick air pocket type of declines. Now it is time to start paying attention to see if this decline is an ordinary one or something to be more concerned about. So far, no alarms are going off but stay tuned.