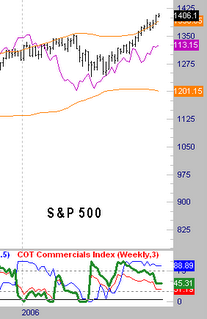

Here is an update S&P 500 Weekly chart

Here is an update S&P 500 Weekly chartWe are working on a 5th weekly close above the 2.0 standard deviation band, hence a tremendously extended market. One development that bears watching is the commercials. They are moving toward that short side of this market.

The purple line is the bond market, which remains strong. When we get into a running market like this with virtually no pullbacks, it is very dangerous to step in front of it. A reversion at the very least will occur, but timing it is impossible. Some traders I know will just probe over and over fighting trends like this until they hit the number. They do not mind taking alot of small losses as long as they ultimately get the big win.

I do not subscribe to this theory. I do have a short trade on right now, but it is very short term, and generated by my system. This in no way means that I am calling for a major top yet. Pullbacks are still buys in this market.

Here is what could change that. First, a break down in bonds, and second, a heavy short position by the commercials.

No comments:

Post a Comment