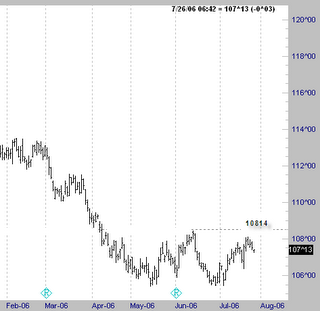

Today let's follow Friday's post on the 60 min bond chart. In the newsletter this month I cover a top down approach of looking at different time frames in setting up a trade. I go from a weekly chart down to a 60 minute chart.

Today let's follow Friday's post on the 60 min bond chart. In the newsletter this month I cover a top down approach of looking at different time frames in setting up a trade. I go from a weekly chart down to a 60 minute chart.As of this morning at about 7:30 the bond chart looked like this. We do have a setup to begin looking for a short entry into this market.

There are several ways of trading something like this. First you could draw a trend line up from the lows, and wait for a break of it to enter a short position. Second, you could just blindly short the market and place a wide stop above giving this divergence room to play out (not recommended).

You could go to a smaller time frame such as a 15 min chart and try and get a jump on any breakdown that might be starting when it does.

Or you could just wait for a daily bar pattern to set up confirming this trade.