30 Yr Bonds

30 Yr BondsThere is alot of talk out there everyday about interest rates rising. Keep in mind that there is an inverse relationship between bond prices and yields. Higher Bond prices = lower rates and vice versa.

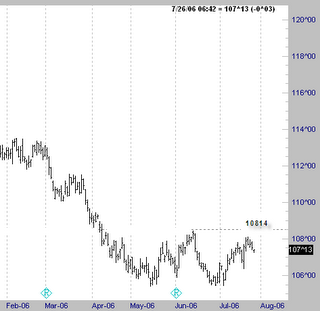

As you can see from the chart to the left, a short term rally in bonds has taken place. At this point 10814 is the key level. If we get above that price, the downtrend that has been in place will be broken. If you keep this in mind with the higher time frames as a reference, it is possible that long rates could begin to come back down, if we get above that price. The monthly chart has still held it's long term uptrend line so far, although it is right into it here on this recent low last month.

If prices turn back down from here then all this was just a bear flag basically. The commercials are in somewhat neutral territory at this point, so they are not helping clarify things much. In general, the seasonals support price rallies at this time of the year, with the ideal low being in the May - June timeframe.

No comments:

Post a Comment