DAY TRADING

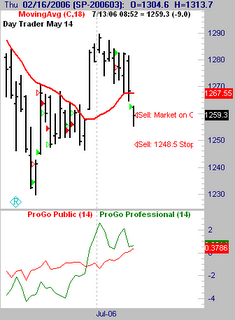

DAY TRADINGI do not do alot of day trading. My system only fires of a trade on average about once every 8 - 10 days. I have displayed the one I have for today. This specific trade is based on buying a gap down opening, and exiting at the close of the day, win or lose.

The stop loss is displayed below. Having studied many approaches to day trading, I can tell you the following. Those who claim to make millions doing that are for the most part lying. There are a few traders who can do this, but it is very difficult. My approach is simply to take a position early in the day, and just exit at the end. As can be seen, at the time of this post, this trade is losing money. We will know by the end of the day whether it is profitable or not.

I do not get too tied up in all of the intraday swings. There is so much stress in watching every tick. There was a time in my career where I did that. Many intraday traders will focus on a 1,3,or 5 minute chart. Then they will use a bunch of technical indicators that they subjectively interpret, which leads to buying and selling decisions.

I may in the future, incorporate this method into my trading service. It is very volatile, and not for the average person to use. I trade a much lessor percentage of my trading accounts with this system, than I do with overnight positions.

No comments:

Post a Comment