Here is the updated GOLD Chart

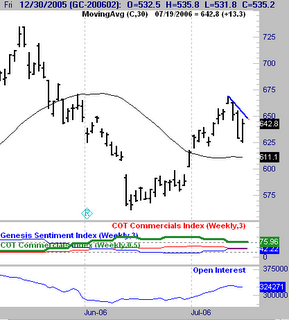

Here is the updated GOLD ChartI know many of you are very bullish on GOLD. Currently this market has formed a bull flag pattern as marked by the blue line drawn across 3 lower highs. This is in general a continuation pattern for an upward move. HOWEVER!!!!!!!!!

Notice how large the range in the price bars is compared to other recent bars. This is an intangible comment, but what you really want in a pullback to enter a breakout longside trade, is a tighter smaller range type of flag. These more volatile flags are more prone to failure.

The textbook says to buy a breakout above the blue line, and place a stop below the low of it. This is not a trade that I would advise doing. Go back and look at old charts for continuation patterns like this. What you will see is that the small tight ones provide the best breakouts, and smallest risk.

This could go higher, but it is an extremely wide stop and not for the faint of heart.

No comments:

Post a Comment