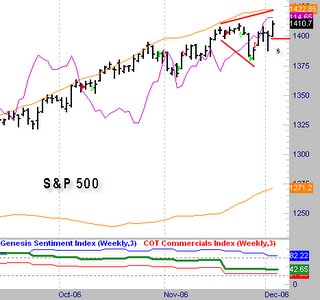

Megaphone

MegaphoneThis is the S&P 500 as of the close of today. I have drawn in containment lines that resemble a megaphone or broadening type of pattern. There are certain ways of trading these types of patterns that are profitable.

I have drawn in a s below the horizontal red line which represents a possible short entry for Tuesday. This is just below todays low. If this low were to be taken on Tuesday, it would represent a false breakout to new highs today.

This is a discretionary pattern that is hit and miss, but if you go back and look at March of 2000 in the NAZ, you will see this pattern right at the highs. I have traded this pattern on all time frames and had some big hits, and also periods of losses. I point this out to beginners just as a field of study. I also continue to study this to see if there is any way of making it mechanical. I have not as yet found a way of doing that.

As a result, this is just a feel type of pattern. There is no doubt that there is major manipulation going on holding this market up this high, so we are really fighting the house shorting this market. However, this pattern does seem to conveniently show up at major turning points often. It bears watching.

No comments:

Post a Comment