PSEUDO FORECAST PART DEUX

Here is the next market I want to cover, the Greenback. However, I want to mention the COO stock trade again that I have been covering live. The exit for today on that would be any close <= 69.98. The entry was 70.59 so if this happens this will not be a great trade, but it will be a profit. I have done a few others that I have not mentioned in stocks with this new tool, and all of them have been closed profitably so far. I just mentioned this one since it was the first one I did, and it was somewhat of just a live experiment with an actual specific trade called out in advance. I guess I am wetting every one's whistle with this, or at least trying to!

I think we are going to see an up year in the Dollar this coming year, or at the very least the larger moves being up, at least during the first half of the year. My tools do not give me much vision beyond 6 months out, so I would just be guessing at that point. I am a terrible guesser so I stay clear of those types of decisions. Of course when I am being a loose cannon and running my mouth at times, I do step outside a 6 month window from time to time. I am taking a contrary position of what most people expect here, so let me explain why I think this will happen.

Most currencies are in downtrends on a weekly basis, some more pronounced than others. The DX is in an up trend as per where I marked it on the chart. Although I never gave the specific rules, the daylight you see above those bands where I have the arrow, is a trend change in my world. Once we see that pullbacks are buys, and you can see the first pullback here was a dynamite buy. They usually are. We have a strong seasonal tendency for the Dollar to rally at the beginning of the year as I have drawn on the chart. If you look at the bottom of the chart, we can see that the new toy is almost in the sell zone. What this tells me is that we will have a pullback in the first month of the year, which will be the buying spot for this market, and the selling spot for the individual currencies.

As with any forecast, I am anticipating things to some degree which I don't often do when I actually trade. When you are looking out 6 months you have to do some of that. The other reason that I think this rally will occur is that I am expecting weakness at the beginning of next year in the stock market. The total lack of any meaningful rally here to close out the year in stocks, tells us we have some problems. Since we know that the DX trades opposite of the stock market, I have to be bullish there if I am bearish for stocks during the first half of the year. There is so much government intervention now that I think things might be choppy. They have shown no tendency to back off in any way, they are actually ramping up the moves now. It is an election year, and a stock market slide is going to doom Barry. I expect the Fed to begin to be active again if we start to decline. This should be good for us short term traders, but it is going to cause long term holders fits.

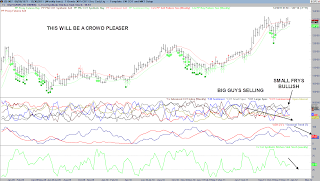

This next one is sure to be a crowd pleaser.

I know I have readers that think the Bond Market is a bubble, you may be right. I do not have that opinion simply because bonds prices should and always have moved higher during crisis periods. This is where the Gold people miss the boat. It is alleged that Gold has always also done so but if you look at charts, it has not always risen during crisis periods. It is argued that Gold should rally being a commodity with intrinsic value, during crisis periods. However as some astute people have said, it is just not in the data. Bonds rally during these times for obvious reasons, rates are lowered to try and save the day when things get bad. We certainly do have now and have had, this situation for some time now. This is why the Bond Market has rallied. However, this market is setup as well for a sell as anything I have seen in a while.

We have a pretty bullish position with the small specs, indicated by an arrow on the chart. This is accompanied by the commercials selling. We are at the time of the year with one of the most reliable seasonal patterns in all of the markets. Bonds very often decline in January, as I have marked with the arrow on the chart. We are also approaching the short term sell zone with my new tool. I showed a chart the other day demonstrating how well that tool works in this market. In summary, on a weekly basis this is setup very well. The next chart is a daily chart, and I think a sell entry is here any day now.

I mentioned recently that there was quite a bit of divergence in the POIV indicator developing in this market. You can see on the chart how prominent it has become. I think at this point with a potentially lower short term high forming any day a prior days low goes, that this is a short the first low that gets taken out.

We also know that there is a pretty reliable low that typically develops in the June/July time frame. As a result it is not too much of a reach to expect Bonds to decline for the next 6 months overall. The one variable that has to be considered of course is the potential for QE3. If the stock market does happen to get into some trouble, you can be your sweet .... QE3 will be announced. At some point though I fear that all of this meddling is going to fail to move things much. I think at some point the market is going to almost become immune to the manipulations. We have not reached that point yet. As a result, my call is for lower bonds for the first half of 2012. The weekly uptrend is still intact, so nothing really bad happens here until that changes. I also think for those who think this is a bubble, it won't pop until the stock market has a huge rally.

More tomorrow

No comments:

Post a Comment