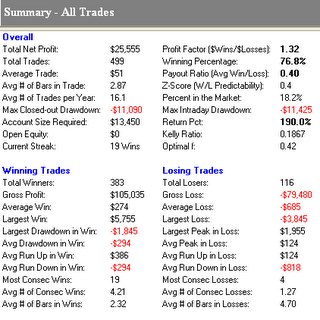

The following two tables examine two different ways of buying gold, and the results of them. The first table shows buying gold on the opening every day since 1975, and exiting the first profitable open. It utilizes a $10/ounce stop loss. Keep in mind that over that period there were several rallies and declines in price.

Clearly this is no way to make money investing in gold. Let's make just one change and examine what happens. The second table buys gold the next day's opening following a close that is the lowest close of the last 20 days. As you can clearly see, this is a much better way of making a profit trading the gold market.

The point of all of this is, be disciplined about how you choose your entry point.

2 comments:

From reading your posts, I am learning the importance of discipline. I so much want to jump in and buy gold, but will wait for the right time.

Can you explain who are the Commercials in the S&P500? Who are the insiders in the general stock market?

The big institutions, funds etc..

Post a Comment