Crude Oil

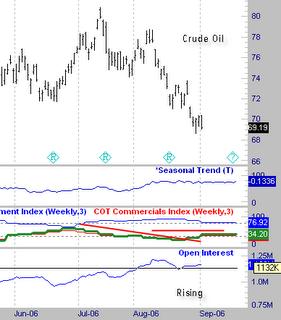

Crude OilLewis, here is a current chart of crude in response to our exchange on this market. We are in a downtrend in price and the commercials who had gotten heavily short as marked by the downtrending red line, have moved back to neutral ground.

Open interest is not declining which is what we would want to consider long positions. That is somewhat simplistic and has exceptions, but is the general rule.

So we have a downtrend in price, and really nothing fundamental telling us to buy it, so short the pullbacks until this changes. If you go back to the post from mid August on this market, you can see how we have fallen further from the spot where I pointed out that the commercials were short.

Things do not always follow the script this perfectly, but it is suprising how often they do when you are keyed in on the right fundamentals.

1 comment:

The COT report comes to me as part of my data service, and it is a pay for view item. I do not know if it can be viewed free of charge.

Contact the CFTC and ask them.

Post a Comment