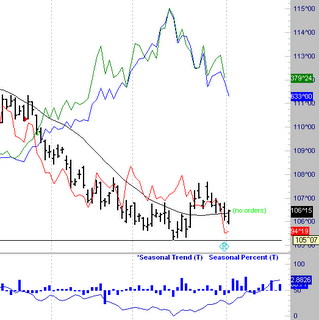

On May 25th I had posted a discussion of a long side trade entry that was not taken. I discussed why that decision was made. As can be seen here, that was a wise decision. That particular signal which had never been wrong, was this time.

On May 25th I had posted a discussion of a long side trade entry that was not taken. I discussed why that decision was made. As can be seen here, that was a wise decision. That particular signal which had never been wrong, was this time.How did I know to do this? I examined the pattern very closely, and found something in the current setup, that had not been present in any of the prior trades. As a result, I modified the setup to exclude this unique circumstance.

I could have easily just fired the black box signal off, and taken a loss. At times this is the correct step to take. However, the premise behind the entry setups always have to be kept in mind. If something at hand in the present, makes it unique, it is better to pass the trade by.

I like trading when the deck is loaded, not when there are question marks. Not every decision like this one turns out to be correct. However, over the long haul, this type of analysis provides very good returns.

2 comments:

Chris, I noticed you took only 3 trades last month. This gives me even more comfort in following your recommendations. You only make a trade when all the odd, to the best of your knowledge, are in your favor.

Yep, this system just trades about 40 - 50 times per year. That is necessary, to be highly accurate. The odds are simply not favorable every day. I did do some S&P trades in May, but those are not part of the service at this point. I may add that later, but it would raise the price.

Post a Comment