FUTURES TRADING AT IT'S WORST

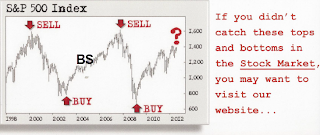

This is a scan of a post card I got in the mail today. Mark my words right here and now, I will never as long as I live sell my soul and lie like this in an attempt to get subscribers. Here is the worst part about this, I was actually subscribing to this persons newsletter at the time these claimed calls were made. Guess what, this is not what they called for at the time. In fact not only did they not get the low in 2009 as they have marked here, they steadfastly called for 5500 in the Dow, even after the rally started. If you were trading either Dow Futures or S & P futures, or the E mini S & P futures, you would have repeatedly lost on trades listening to this groups advice. They repeatedly called out selling spots all the way up in both stocks and other commodities markets, and were dead wrong on all of them as well, resulting in me cancelling. I am always willing to learn something from someone else, and that is why I was reading this guys work.

This is a disgrace and gives all of us a bad name. I did email them complaining about this false advertising. Please do not fall for this type of ploy, nobody catches every swing like that, NOBODY. The BS in the middle of the chart is my commentary, that was not on the post card. Hopefully anyone who reads here either before subscribing to anything I have to offer, or does so afterwards, will understand that I call it like it is. When I am wrong I admit it. I just don't understand the logic of being a liar? You may get people in the door, but they won't stay. My intention is to get a core group of people who stay with me. Arghh this really ticked me off when I got it when I saw who it was from. I have an example in my site ironically which is getting close to launching, that I am going to replace with this unless there is a legal issue with doing so, as an example of what not to be fooled by. Nobody is that good including me.

We are mostly in pullback buy mode in places with a couple of exceptions. The energies are in a spot where I would not call them pullback buys, but more in transition. They need to rally some to re-establish their up trends, or bounces are sells. I don't see a play right here.

You saw today why I took the Bean Oil long as a short term trade. By my rules it was against the trend after the big break. I do not overstay my welcome against the trends. Some times I get out too soon on counter trend trades, but I am not in the business of being a hero trading against trends. I have watched that movie on Cinemax for years and am not interested any more. Most of you will eventually have to learn the hard way not to trade against the trend, regardless of what people like me tell you.

Here is the world's favorite market in a sideways consolidation move. This is winding up for a move in one direction or the other, so breakout mode play is the way I am looking at this.

I am still looking for Joe Theisman's wife for an interview. I am not buying that he sleeps through the whole night. I think he is getting up many times and pissing her off to no end ( pun intended ). For those who don't understand this, be thankful you are not hearing those commercials all night long.

Good Trading

8 comments:

Steve Briese...

Chris,

I received the same postcard and know what you are saying is true. The same guy also had a webinar (sales presentation) recently. I have known him or of him long enough to know he is a brilliant guy but his presentation was just awful with all the ums and ahs and complete incoherence. I felt bad for the guy.

Anyway as far as posting it as an example on your site I would recommend using multiple examples in addition to his, then you can't be accused of attacking just him whihc is not your intent anyway. What you really want to do is alert viewers to the lies and misrepesentations that are out there. And again as you always point out, the onbly "advisors" worth following are those who trade their own stuff instead of just writing about it; it's like the difference between trading a demo account and trading real money.

Looking forward to the new website,

Don in Virginia

I think you're right about Theisman. Back here in New York, we still get these radio commercials with Joe Torre plugging Bigelow green tea. Have you seen Joe Torre lately? If that's what the stuff does for you, I'm sticking to Coke Zero.

John that is funny. Yes I have seen him. My problem is the opposite I am very lean and muscular and run the risk of being that dude at the super market with no ass and bad posture when I am 80. I know I will have a hard time keeping weight on when I get older.

They say don't be that guy, I don't want to be either of them!

Coke Zero for everyone!

Don I also went to one of his seminars and I agree. He is not a very articulate speaker even though he is intelligent. He does have good knowledge he is just not good at determining how to use it to trade. I don't think he does trade. I think he just writes about trading.

Do we have a similar reversal bar on the ES daily chart like the one you pointed out last weekend in soybeans?

Vikas

No this is not the same because the last pivot prior to the last high has not been taken out. As a result, there is not a short term trend change yet.

Chris, In case of a breakout to the downside where would you put your first target objective for example?

Sergio, which market, Gold? If so, I am not playing breakouts to the downside there only the upside at the moment. If we were to break to the downside I would say about 1716 would be the first place I would look.

Post a Comment