CRUDE OIL

CRUDE OILI am posting this Wednesday after the close. Crude Oil has come down a bit here in recent weeks, so let's look at the dynamics of this market.

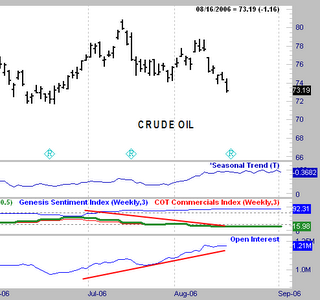

First notice how the commercials have been steadily moving to the short side since the beginning of July and are now heavily short. Also at the same time look at open interest rising during this same period. What this tells us is that a rising percentage of positions were by the non-commercial players which is always a bearish sign.

Also notice how bullish the sentiment index is, yet another bearish sign. So at the beginning of July we have rising open interest, declining commercial longs, and bullish sentiment. These are what tops in price are made of. Does this mean we will have a huge fall, no. What it meant at the recent highs was that this was a selling opportunity until the above fundamentals change.

No comments:

Post a Comment