HOUSING STOCKS

HOUSING STOCKSI have been asked quite a bit recently about shorting housing stocks and lenders. Many people know of my forecast about a year ago for a drop in the housing market. If I am so bearish on housing, am I short the housing stocks?

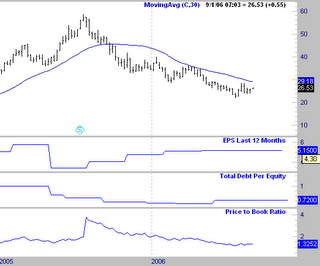

The answer is no, and the chart to the left of TOLL Brothers shows why. I have learned over the years that there is an upward bias in general to the stock market, so taking short positions really requires a "loaded deck." Loading the deck in stocks for me requires, trading in sync with the trend, and having valuations that match that trend.

In uptrends I want low debt and low valuations and good earnings, and in downtrends I want high debt, high valuations, and declining earnings. As you can see from the chart to the left we do have a downtrend in price. However, as we review the other 3 categories we see that we have rising earnings, low debt, and low valuations. These are the opposite of what I am looking for to short stocks in a downtrend.

As a result of this there are no short trades. It is really as simple as that. I do not inject my opinion into my model because opinions can be so arbitrary and hence unreliable. I do believe housing is in for some trouble here, but I do not ignore my model EVER! I may miss some opportunities, but I focus on the ones I do pursue, not the ones that got away. There is always another trade, but there is not always more money for the next trade if you have chased too many marginal opportunities.

No comments:

Post a Comment