S&P follow up

S&P follow upIt was good that I followed my rules (I always do) on this setup. We had a strong up day today, and that short trade I mentioned earlier would be underwater so far. This is why it is so important to have your trading rules line up as many things as you can supporting your decisions. That approach will keep you out of trouble for the most part. Trouble will find you in futures anyway, so why not avoid it when you can.

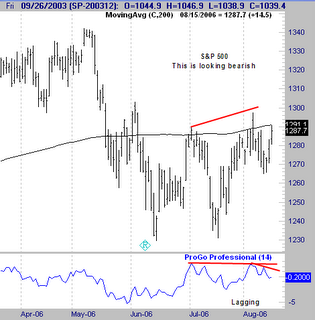

The chart I have here shows what I consider to be a bearish setup in the works. Notice the negative divergence between the ProGo indicator at the bottom and price. Insider buying is lagging this push up we are having. The bond market is supporting it, which is a positive. The commercials are currently in middle ground.

We have a seasonal tendency for a decline, so when we combine this with this lack of insider buying intraday, this sets us up for a fall. Ideally, what would happen is that we take out the high of 7 days ago, with the ProGo lagging this move. This would setup a short sale opportunity. What we currently have is a developing situation that needs to be watched. My system does not have any sell signals yet, but I am studying this closely to see if there is a pattern at hand to act upon. Nothing yet, but if I find one I will post the trade here.

No comments:

Post a Comment